Know Who Your Talking To

What is the difference between a bookkeeper, an accountant, a tax agent and a tax consultant and why it's important?

When you need to submit your individual or business tax returns, BAS or GST return, you need to select the right people for the job. You also want to keep your costs to a minimum whilst obtaining the best outcome possible. Not only do you need to contain your costs, you also need to be sure that the person you are asking to advise you or keep you compliant is suitably qualified to do so.

If you are an individual, you are probably curious why some places can prepare a return in ten minutes and charge from $80 whilst others may charge five times that amount.

If you look after a business structure, the lines between bookkeeping and accounting may seem very blurry. You may wonder who is supposed to do what.

The details below explain:

- Why people charge the fees they do.

- Which people do which jobs.

- How to keep your costs down by giving the right jobs to the right people.

- Who should advise you on what matters.

An Accountant

A qualified accountant will belong to a Professional Accounting Body

- National Tax and Accounting Association (NTAA)

- Institute of Public Accountants (IPA)

- Chartered Accountants Australia - New Zealand (CA)

- CPA Australia (CPA)

To gain membership to any of these, an individual must demonstrate a high level of competence by meeting specific educational requirements, have a minimum level of mentored work experience (typically between two and ten years, depending on the level of membership) and be deemed a “fit and proper person”. Members must conform with accounting standards and abide by the APES 110 Code of Ethics for Professional Accountants. They may also be members of other professional bodies reflecting their specialization, such as Chartered Tax Advisers, Fellows and Associates of the Tax Institute of Australia (TIA).

Accountants, depending on their specializations, prepare financial reports for companies, prepare audits, provide advice on taxation issues, provide legal advice on the structure of companies, and manage their clients' compliance issues with the ATO and ASIC.

Some accountants are also registered tax agents If your accountant is not a Registered your Tax Return your return is handed to one to be reviewed and lodged with the ATO most accounting practices have at least one registered agent . Registered tax agents are the only people legally able to charge for the preparation of tax returns

A Bookkeeper

Will assist you to record your transactions according to accounting principles. They will turn a “shoebox full of receipts” and bank statements into documents where that information can easily be categorized and sorted for reporting purposes.

There are no formal educational or professional requirements to be a bookkeeper, however, many bookkeepers are members of professional associations and have undertaken study.

A bookkeeper will advise you on:

- What record keeping system and accounting software to use.

- How much work will be needed to maintain your financial records.

A bookkeeper should:

- Record your transactions into Excel, MYOB, Quickbooks or other system.

- Make sure your income and expenses are recorded according to accounting conventions.

- Liaise with your accountant for oversight and assistance.

- Prepare your records for your accountant to perform compliance work such as the lodgment of your tax returns.

A BAS agent

All tax agents are BAS Agents but not all BAS Agents are Tax Agents. Some bookkeepers are BAS agents. Only BAS Agents and Tax Agents can charge you for GST advice and prepare and lodge your Business Activity Statements (BAS). They are recognised by the government as professionally qualified.

Any person that provides tax or BAS services for a fee while not being registered with the TPB puts you at risk and can be fined.

A Registered Tax Agent

Is formally recognised by the government and is authorised to charge for tax advice and lodge tax returns. A Tax agent can be a company, partnership or an individual. A Tax Agent represents their clients to the ATO, and does NOT work for the ATO.

For an individual to become a tax agent, they must have a minimum of 2 years tax experience and have met educational requirements as well as being deemed a “fit and proper person” by the authorities. They may or may not be a 'qualified accountant'.

Tax Agents usually charge “per return”. Their fees tend to reflect the time spent and level of expertise needed to prepare your return. A tax agent is qualified to take a detailed look at what expenses can be claimed as a deduction. They are trained in how tax law applies to whether particular expenses can be claimed and in what circumstances, and should be able to explain this to you.

A tax agent will advise you on:

- What income is subject to tax.

- The types of expenses you should record during the year.

- Tax planning, and how to maximise your deductions.

- Legal issues relating to tax compliance

- Depending on the terms of engagement, provide ongoing advice on tax matters throughout the year.

A tax agent will:

- Prepare your tax return for lodgment.

- Provide taxation advice.

- They may also prepare your BAS for lodgment.

Tax Consultant

A company which is a registered tax agent may employ staff as “Tax consultants”. A tax consultant is not legally recognised in any capacity, nor do they need to meet any work experience, educational or training requirements save those set by the company for which they work. In some cases, this involves little more than attending a short 8-16 week self-funded non-accredited course.

The fees charged for dealing with a tax consultant are generally set by their employer. As tax consultants usually aren't professionally qualified, their employers tend to set strict guidelines about what expenses to include as deductions so as to minimise the risk to their employer therefor may not provide you with the best return or advice that can save you thousands.

What record keeping system should I use?

Your bookkeeper and accountant, preferably a BAS or Tax Agent, should advise you on the most appropriate system to use. The choice of system to use depends on the business, the number of transactions which need to be kept track of and who is keeping track of them.

With the introduction of Cloud

Accounting there are many options available you accountant

will advise you on what is suitable for your business taking

into consideration your GST status, Employees, Industry and

business needs.

For more information on Cloud

Accounting click on the link or call us on ph. 03 5560 5345

and we will be glad to help

Should I do my own bookkeeping?

If you are a sole trader with relatively few transactions, then there’s a good chance you can look after your own bookkeeping. You should make use of resources and templates offered by your accountant. It can still be a good idea for you to do some training sessions with your chosen accounting package.

If your company has more stringent reporting requirements, it is probably a good idea to have a bookkeeping reviewed regularly to keep things in order. Not only will this help to keep your records compliant, it should also enable your accountant to provide valuable business advice during the year – instead of just focusing on compliance.

At Assist Accounting Solutions we offer Training Sessions in Quickbooks Online and Xero Online Cloud Accounting Packages. For more information go to our Training Page

How do I get the best value from my Accountant?

Your accountant should be a valuable resource who can help you with business and tax planning throughout the year.

Decisions such as:

- Whether and how to purchase expensive items of equipment.

- Cost and tax implications of taking on contractors or employees.

- Whether to change from a partnership to a company.

- Whether to buy a business.

Questions such as:

- How grants and funding can affect your tax position.

- Whether to register for GST.

- How PAYG installments work.

- How your business is performing compared to similar businesses in the same field.

Can all be addressed by your accountant.

Keeping your books in good order is the single best thing you can do to get the best value from your accountant. This enables your consultations to focus on business and tax planning and minimises the time it takes to prepare your reports. If you don’t need planning or advice, then it will simply keep your consultations shorter and therefore cheaper.

How do I get the best value for my Personal Tax Return?

Obviously, the fee to prepare your tax return is a factor and the old adage that “you get what you pay for” dose not hold true in some cases.

Franchises and some larger practices may use Tax Consultants and run there own in house training courses for periods from 8 to 16 weeks unlike an Accountant / Tax Agent who has studied for years. Larger Practices have larger overheads and these costs need to be covered so a smaller accounting practice may charge less but also give you a better more personal service.

If your income and deductions are very simple then you may think its cheaper to lodge your own return. But how confident are you in doing that, do you know what can be claimed in your industry, are you up to date with the latest changes in tax law. You may have some expenses which are partly for your work and partly private – like your mobile phone. There may be items which you aren’t sure about, like a film you went to see; or an interstate meeting where you met up with some friends afterwards. If that’s the case, it might well be worth meeting with a well qualified person who can spend more time assessing your tax position. Maybe you’ve been studying and working and aren’t sure whether you can claim your course fees.

I got alot of money back last year and none this

year! Does my tax agent suck? :-P

Whether you get a refund or owe money is mostly to do with how much you earned and how much money was withheld by your employer or other entities on your behalf throughout the year.

A good tax agent will identify more deductions and form sound legal arguments as to why certain expenses can be claimed on your behalf. Or whether particular principles or concessions apply to you. All of this makes a difference but it isn’t often why you get a great refund (well, sometimes it is!) or owe money to the tax office.

A huge number of things can affect whether you are going to get money back or owe it. If you have a HELP or HECS debt, you may have needed to repay it this year and forgotten to tell your employer. You might have come into some money which earned bank interest. Or perhaps you only worked for a part of the year and your employer withheld a lot more tax than you owed.

Whether you have a good tax agent is really about what factors they identify to improve your position. It might suck to owe $2,000 in tax, but your agent might have saved it from being $4,000. Conversely you might be getting a $3,000 refund from a bad agent – when, all things considered, you should have got twice that.

I’ve started up a small business and want to choose an accountant. How should I go about it?

Selecting the right accountant is a very important decision when starting a business. You need:

- Someone who communicates well with you.

- Who understands your business.

- Who can advise you.

- Who will help keep your reports compliant.

- Who charges reasonably and fairly.

Most accountants will offer short consultations free of charge to enable you both to decide whether there is a good fit. In that free consultation, you should be able to establish:

- Whether the accountant is properly qualified (look at the certificates on the wall and ask!)

- If they are someone you feel happy you can work with.

- The scope of their services and terms of service, including fees.

- If they'll send your business information to third parties or offshore contractors and, if so, whether that's acceptable to you.

- How they will work with you or your bookkeeper, or whether they will provide bookkeeping services.

Things to remember:

Accountants are very busy at certain times of year, such as meeting Tax lodgment and BAS deadlines. You’ll get a better hearing if you make it clear that you are a new business and are looking for a brief discussion to choose your accountant. Ask for a “least busy” time to meet up.

Prepare a short explanation of what you need from the accountant. Preferably you should email this before you meet:

For example: “I’m an employee who also runs a weekend market stall under my ABN. It’s become more successful and I think I may need an accountant. Do I need to register for GST”, or “I’m about to set up a restaurant with my husband and we need to find an accountant”.

Your prospective accountant will also be assessing whether they would like to accept you as a client. If the accountant feels you are well prepared, easy to communicate with and serious about managing your business, they will be much keener to take you on as a client.

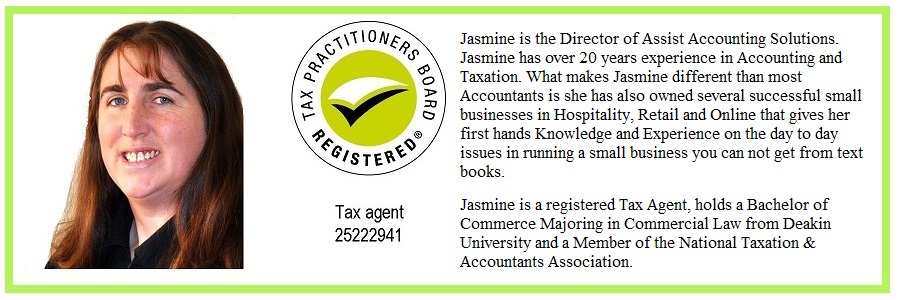

At Assist Accounting Solutions we offer affordable Tax and Accounting solutions for both Business and Personal clients all under one roof.

Contact Assist Accounting Solutions today to discuss how we can help you.

If your in business or planning to start one we invite you to book a FREE introductory consultation to discuss your business needs. You can expect practical business and tax, advice.

To book a time, call us today on (03) 5560 5345

Room 33 Warrnambool Business Centre

715 Raglan Pde Warrnambool Vic. 3280

PH 0425 741 805